Providing General Contractor Insurance Cost Indications for...

- Cabinet Installer

- General Contractor Shop

- Construction Company

- Deck Builder

- Developer

- Framing Contractor

- Handyman

- Home Builder

- Housing Contractor

- Remodeler

- Renovation

- Wood Worker

General Contractor insurance state requirements vary, we will help you select the correct liability insurance coverage to be protected and legally operate as a contractor in your state.

(GL) - General Liability Insurance for General Contractor

Suit Happens! Lawsuit that is… to any general contractor’s business – at any time – that’s why every general contractor and general contractor businesses needs to be covered by commercial general liability insurance. A customer may claim that a general contractor’sgeneral contractor simple service mistake, defective product, or disregard for the property of others caused harm.

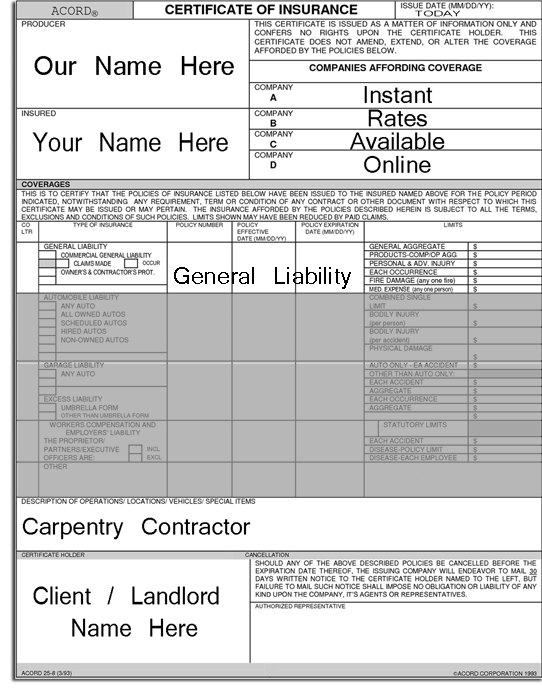

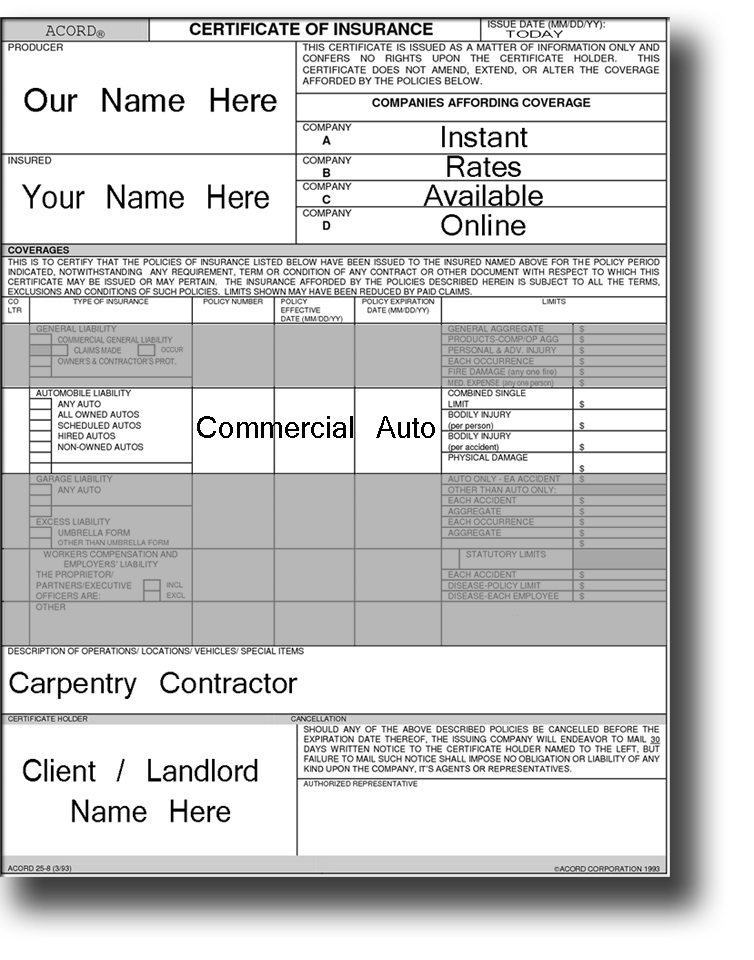

Then there’s that all mighty job killing “Certificate of Insurance with an Additional Insured Endorsement” that allows a general contractor on the job site – or just to get paid for a completed job!

Commercial General Liability (GL) insurance pays attorneys’ fees as well as damages your business is found liable for – up to the limits of the policy. GL will also pay claims of injury arising from your work, a customer’s slip and fall at your business location, or damage caused by you to the property of third parties. Find out how much general liability for general contractor insurance will cost here.

(Click Here for More Information)

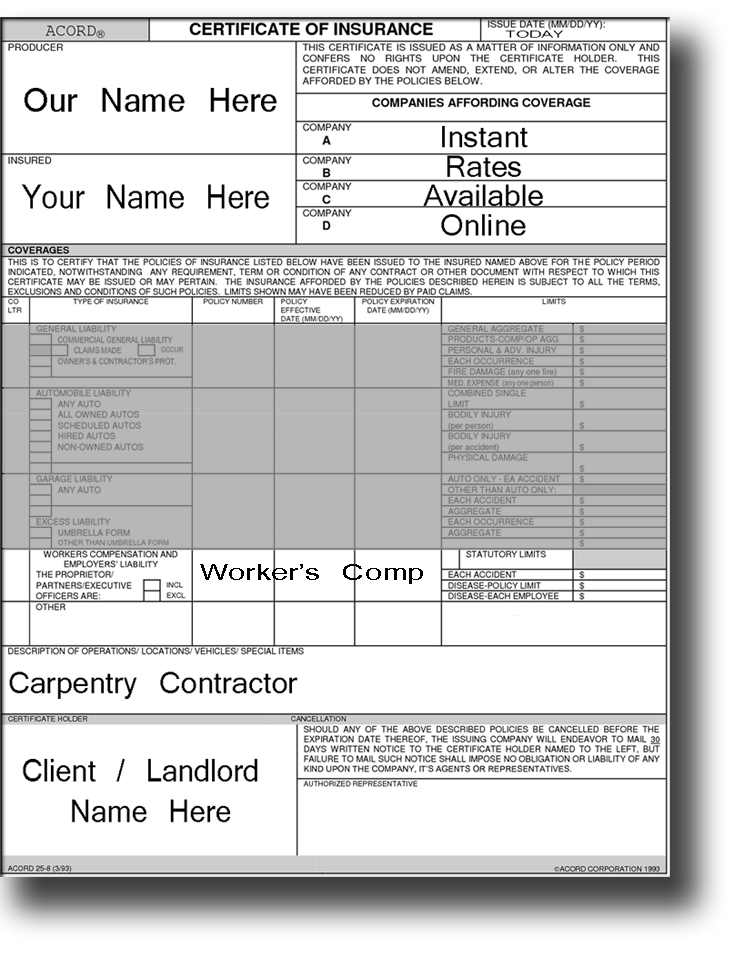

(WC) - Worker’s Compensation General Contractor Insurance

In most states contractors are required by law to buy work comp insurance for general contractor insurance, even for just 1 part-time helper. In fact, some contract bids require a worker’s compensation certificate of insurance – just to get the job – even if there are no employees!

The mandatory coverage protects a general contractor insurance business owner from workplace accident lawsuits and provides medical care and compensation for lost income to employees who become injured in a workplace accident or work-related illness.

Payments are made to injured workers without regard to who was at fault in the accident, for medical services including rehabilitation and for time lost from work or death benefits to surviving spouses and dependents. Find worker’s compensation for general contractor insurance cost here.

(Click Here for More Information)

(CV) - Commercial Auto/Truck General Contractor Insurance

As a general contractor you need the same coverages for the car or truck used for business, as a vehicle driven for personal use, such as; third-party liability, comprehensive and collision, uninsured motorists, medical payments and towing.

If you drive a private vehicle for work, then you need business or “artisan use” added to your personal insurance policy. However if your vehicle is a commercial truck – or you’re required to provide a one million dollar certificate of insurance for commercial auto – then you’ll need to purchase Commercial Vehicle Insurance for a general contractor.

If you rent vehicles for work or your employees drive their personal vehicles for work, you’ll need to add Hired / Non Owned Vehicle Coverage. Get general contractor insurance cost for your truck here.

(Click Here for More Information)

General Contractor License Bond, Contract & Construction Bonds

Determine the bond capacity for your general contractor insurance business with low price leading bond companies – privately – with one simple and secure online form.

Many bond types may be issued the same day, and without delay.

Compare surety bond cost and rates for contractor license or construction bid, performance, payment, maintenance, supply, subdivision and site improvement contract bonds.

Click Compare Rates to begin > > >

Zip Code: 92101

Prior Insurance: 0 Years

Employee Payroll: $ 0

Gross Sales: $ 50,000

Sub Costs: $ 0

POLICY TOTAL:

$795.00

Zip Code: 93711

Prior Insurance: 4 Years

Employee Payroll: $ 30,000

Gross Sales: $ 95,000

Sub Costs: $ 0

POLICY TOTAL:

$1,598.00

Zip Code: 94705

Prior Insurance: 4 Years

Employee Payroll: $ 30,000

Gross Sales: $ 350,000

Sub Costs: $ 25,000

POLICY TOTAL:

$1,132.00

Zip Code: 92101

Prior Insurance: 0 Years

Employee Payroll: $ 0

Gross Sales: $ 50,000

Sub Costs: $ 0

POLICY TOTAL:

$795.00

Zip Code: 93711

Prior Insurance: 4 Years

Employee Payroll: $ 30,000

Gross Sales: $ 95,000

Sub Costs: $ 0

POLICY TOTAL:

$1,598.00

Zip Code: 94705

Prior Insurance: 4 Years

Employee Payroll: $ 30,000

Gross Sales: $ 350,000

Sub Costs: $ 25,000

POLICY TOTAL:

$1,132.00

Zip Code: 92101

Prior Insurance: 0 Years

Employee Payroll: $ 0

Gross Sales: $ 50,000

Sub Costs: $ 0

POLICY TOTAL:

$795.00

Zip Code: 93711

Prior Insurance: 4 Years

Employee Payroll: $ 30,000

Gross Sales: $ 95,000

Sub Costs: $ 0

POLICY TOTAL:

$1,598.00

Zip Code: 94705

Prior Insurance: 4 Years

Employee Payroll: $ 30,000

Gross Sales: $ 350,000

Sub Costs: $ 25,000

POLICY TOTAL:

$1,132.00

– What Other People are saying about us –

Great website! I was able to compare several companies and I saved $300 off my renewal!

John B.Zip Code: 92101

Prior Insurance: 0 Years

Employee Payroll: $ 0

Gross Sales: $ 50,000

Sub Costs: $ 0

POLICY TOTAL:

$795.00

This site made shopping for insurance super easy. Thanks for the same day service.

Janet C.Zip Code: 93711

Prior Insurance: 4 Years

Employee Payroll: $ 30,000

Gross Sales: $ 95,000

Sub Costs: $ 0

POLICY TOTAL:

$1,598.00

I knew I was paying too much for insurance – I lowered my annual policy by over $700 today.

Evan A.Zip Code: 94705

Prior Insurance: 4 Years

Employee Payroll: $ 30,000

Gross Sales: $ 350,000

Sub Costs: $ 25,000

POLICY TOTAL:

$1,132.00

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.